It’s that time of year that most of us dread, Tax Time. But in this one case, I’m glad taxes existed. Recently I uncovered tax assessment lists that could assist in confirming the Kraut family connections. While looking into each and every Kraut record that might be tied to Elizabeth Kraut Keen (Zanesville, Ohio and Indianapolis, Indiana), these two in Madison, Indiana, became important. (See prior posts on Kraut research.) Little did John and Chris Kraut know in 1863/64 that I would be resurrecting and examining their tax records 154 years down the road.

The information contained on these tax lists can be enlightening for family historians. For instance, if I am able to link these Kraut men to my Elizabeth Kraut, I will have background on their occupations, selling retail liquor. In order to understand better the situation, I decided to refresh my understanding of taxation in the United States. Both Family Search and Ancestry provide background on the history and content of the available tax records.I learned that governments have collected taxes in the United States since the colonial era. Depending on local laws, males were usually taxable at the ages of 16, 18, or 21 through about age 50 or 60, with some exceptions for veterans, ministers, paupers, and others. Most tax records were eventually based on personal property, real estate, and income. The federal government directly taxed citizens in 1798, 1814 to 1816, 1862 to 1866, and at other times until 1917 when personal income and other taxes were introduced. Familysearch.org has tax records dating back to the 1700s. (See familysearch.org wiki for more thorough information.)

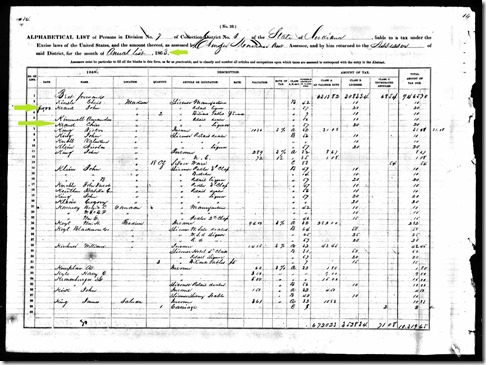

At ancestry.com I learned that the Internal Revenue Act passed by Congress in 1862 created the IRS. The intent of the law was to pay war expenses. Searching ancestry’s files led me down this path to the tax assessments listing John and Chris Kraut. These documents (below) indicate that these two businessmen paid for a Class B retail liquor license in Madison, Indiana. In 1863 they were each assessed $20.00 and in 1864 the fee was $4.17. I wonder if the higher amount in 1863 was to create a reserve, which then kept down taxes in 1864. Who knows? There’s much more to this story, I’m sure. A very brief analysis of the two pages of tax information below seems to reflect the same rate of tax for people in the same business. Although, it appears that the types of items taxed in each year may have differed. I see income taxed on the 1863 page but not on the 1864 page. Also, I note there are no animals listed in 1863, but there are taxes on cattle on the 1864 list. Of course, one page doesn’t present a very thorough picture.

Here’s an excerpt from the resource information provided at ancestry.com which sheds some light on the documents listing the two Krauts and others in their Collection District 3, State of Indiana:

---------------------------------------------------------------------------------------

About U.S. IRS Tax Assessment Lists, 1862-1918

On July 1, 1862, Congress passed the Internal Revenue Act, creating the Bureau of Internal Revenue (later renamed to the Internal Revenue Service). This act was intended to “provide Internal Revenue to support the Government and to pay interest on the Public Debt.” Instituted in the height of the Civil War, the “Public Debt” at the time primarily consisted of war expenses. The Internal Revenue Act also established the Office of Commissioner of Internal Revenue and allowed the country to be divided into collection districts, of which assessors and collectors were appointed.Taxable goods and services were determined by legislative acts passed throughout the years. All persons, partnerships, firms, associations, and corporations submitted to the assistant assessor of their division, a list showing the amount of annual income, articles subject special taxes and duties, and the quantity of goods made or sold that were charged with taxes or duties. The assistant assessors collected and compiled these lists into two general lists. These lists were:

1. A list of names of all individuals residing in the division who were subject to taxation

2. A list of names of all individuals residing outside the division, but who were owners of property in the divisionThese lists were organized alphabetically according to surname and recorded the value, assessment, or enumeration of taxable income or items and the amount of tax due. After all examinations and appeals, copies of these lists were given to the collector who then went and collected the taxes.The assessment lists are divided into 3 categories:

1. Annual

2. Monthly

3. SpecialAnnual and monthly lists are for taxes assessed or collected within those periods of time. Special lists supplemented incomplete annual and monthly lists and also included any taxes that were indicated as “special” by the assessors.About the Records:Form 23, Assessment List, was the form used for many years to record tax information. Although there are several different versions of this form, it generally recorded:

--------------------------------------------------------

Let’s hope these additional Kraut records bring more answers to the whereabouts of Elizabeth Kraut’s parents and siblings. For sure, I can see that I need to dig further into references on tax documents to get the full value of the information contained within them. John and Chris Kraut’s liquor businesses may lead me to happy days.

Thanks for visiting Indiana Ties,

Nancy

Copyright © 2017, Nancy Niehaus Hurley

And I'll drink to that...Happy days for you!!! LOL

ReplyDelete